aurora sales tax rate 2021

Those district tax rates range from 010 to. The Aurora Utah sales tax is 630 consisting of 470 Utah state sales tax and 160 Aurora local sales taxesThe local sales tax consists of a 150 county sales tax and a 010 city.

Denver Pols Reject Plan To Increase Transit Sales Tax Put Fastracks Expansion Program In Doubt The Transport Politic

The statewide tax rate is 725.

. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Colorado sales tax rate is currently. As we all know there are different sales tax rates from state to city to.

Method to calculate Aurora sales tax in 2021. The sales tax jurisdiction name is. 0375 lower than the maximum sales tax in MO.

The minimum combined 2022 sales tax rate for Aurora North Carolina is. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. The County sales tax.

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special. 24 lower than the maximum sales tax in CO. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

Updated 12021 Effective July 1 2006 the Scientific and Cultural facilities District CD of 010 consists of all areas within Arapahoe County Effective December 31 2011 the Football District. The minimum combined 2022 sales tax rate for Aurora Colorado is. The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax.

The North Carolina sales tax rate is currently. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. The Aurora Illinois sales tax is 825 consisting of 625 Illinois state sales tax and 200 Aurora local sales taxesThe local sales tax consists of a 125 city sales tax and a 075.

The County sales tax rate is. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city. The minimum combined 2022 sales tax rate for Aurora Illinois is.

Because Angie is a dealer in office chairs they buy them free of Aurora. The President of Angie needs a new chair for her office. This is the total of state county and city sales tax rates.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. The sales tax jurisdiction name is aurora arapahoe co which may refer to a local government division. Angie Office Furniture has an executive chair in inventory.

This is the total of state county and city sales tax rates. You can find more tax rates and. There is no applicable city tax or special tax.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. This is the total of state county and city sales tax rates. The Illinois sales tax rate is currently.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

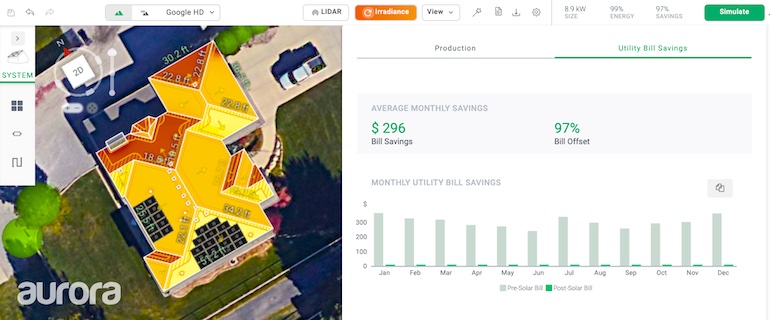

Guide To Business Management Software For Solar Contractors

Sales Tax Information City Of Wasilla Ak

How Uber Lost 5 5 Billion On 4 Spac Ipo Stocks Grab Didi Aurora Zomato How It Got There How They Imploded Wolf Street

State Sales And Use Tax Changes In 2019 And What To Expect In 2020 Accounting Today

Taxing A Fee Some Colorado Cities Profit From Controversial State Delivery Fee Business Denvergazette Com

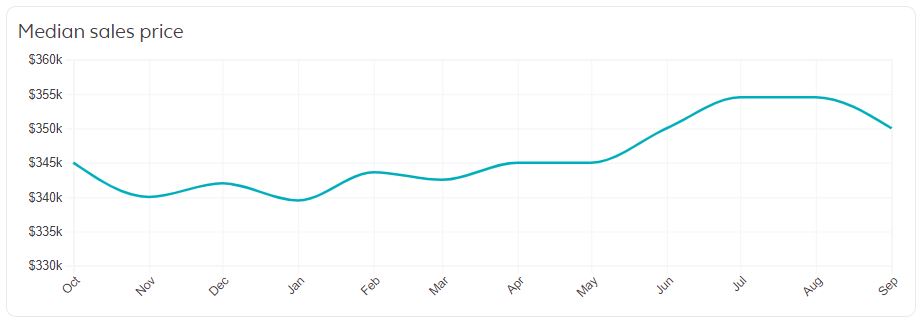

Aurora Real Estate Market Forecast 2020 Rising Prices Rents

Developers That Donated To Gubernatorial Candidate Richard Irvin S Mayoral Campaign Received Tens Of Millions In Aurora Incentives Chicago News Wttw

Proposed Village Budget Includes Tax Rate Increase East Aurora Advertiser

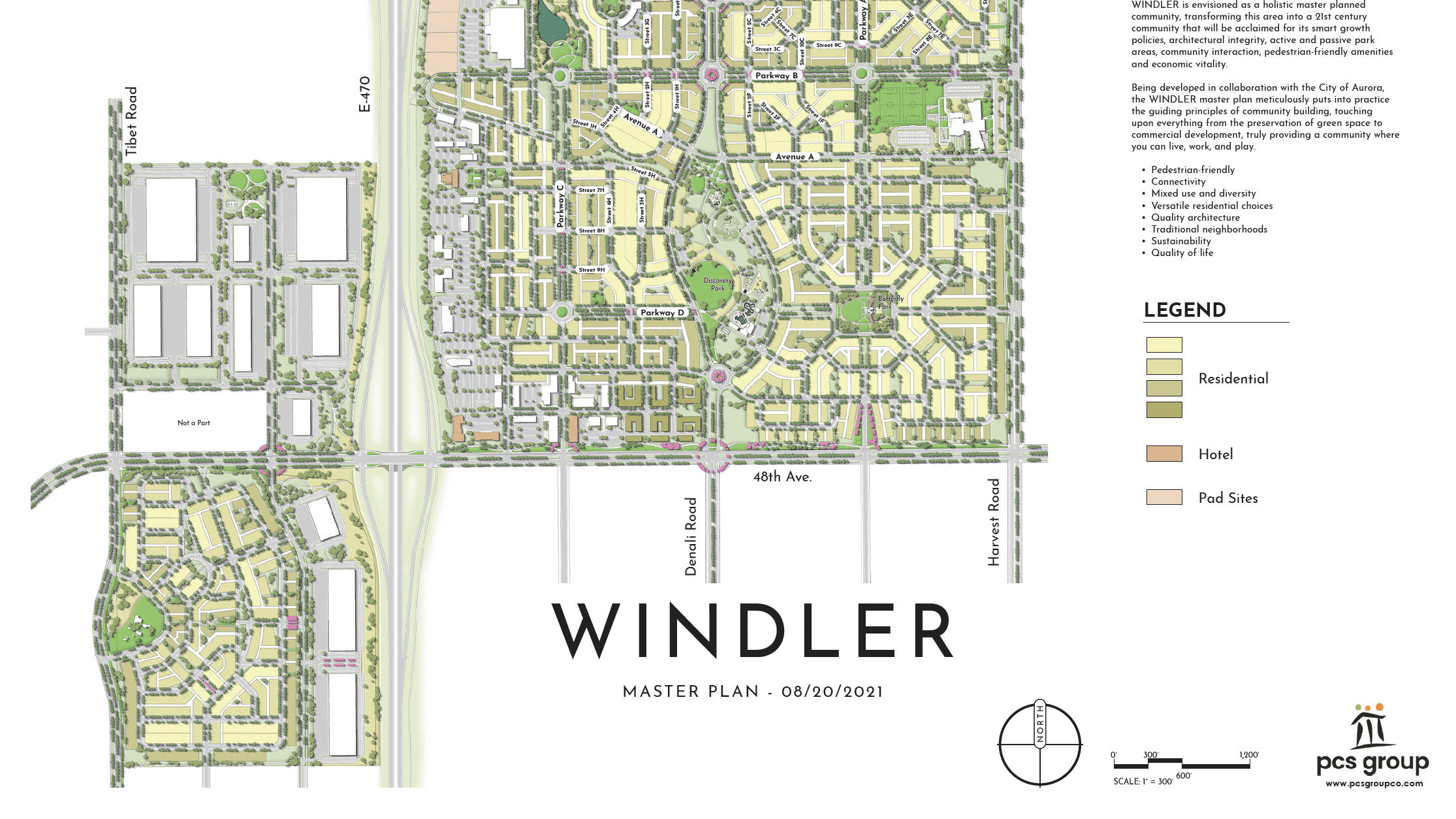

3 1b Mixed Use Development Coming To Aurora Mile High Cre

Illinois Car Sales Tax Countryside Autobarn Volkswagen

City Of Aurora Incentives Invest Aurora

Sales Taxes In The United States Wikipedia

Illinois Property Tax Calculator Smartasset

Set Up Automated Sales Tax Center

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute